Maximising stock picks in

an undervalued market

Finding opportunities in the UK stock market

Supported by

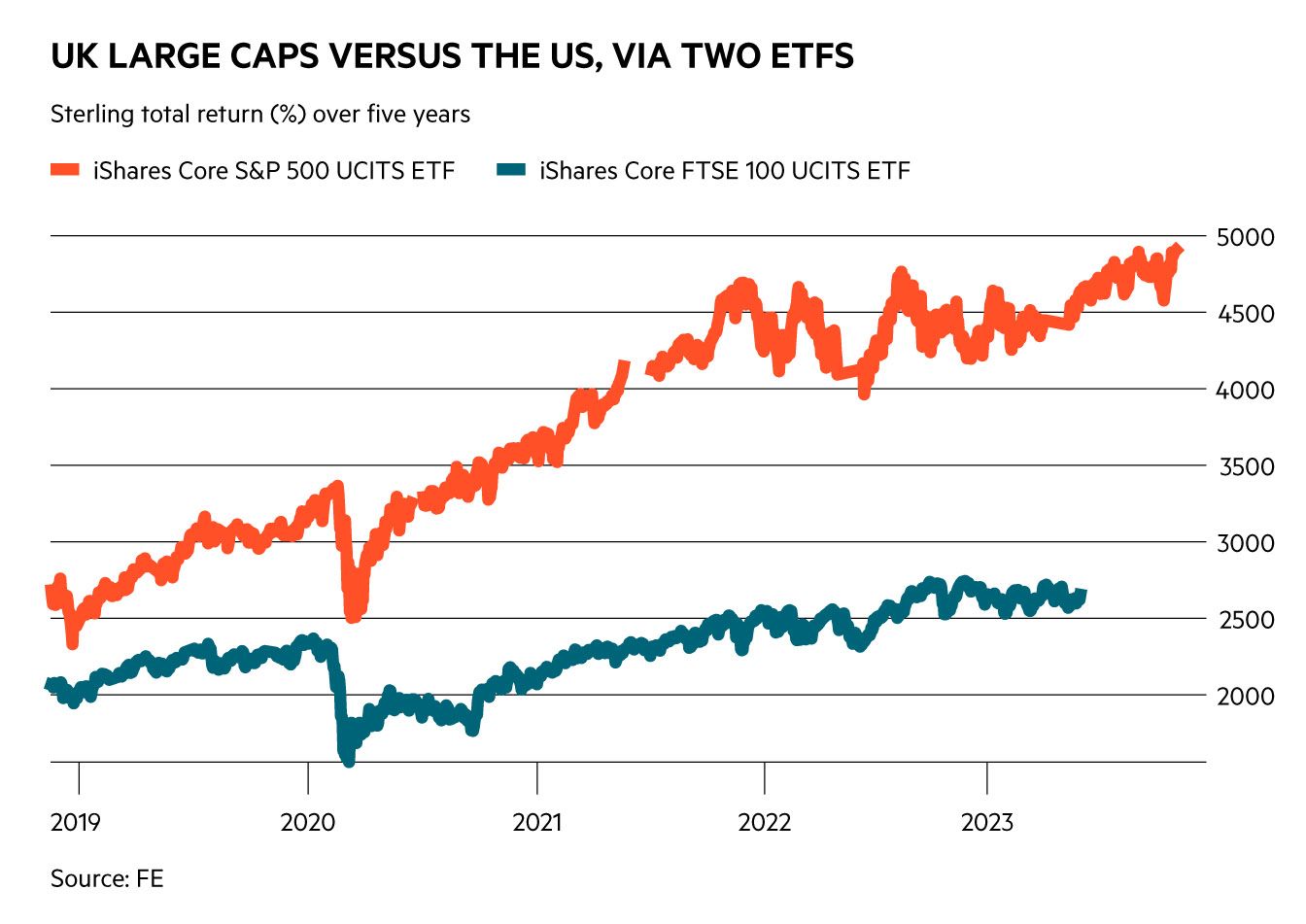

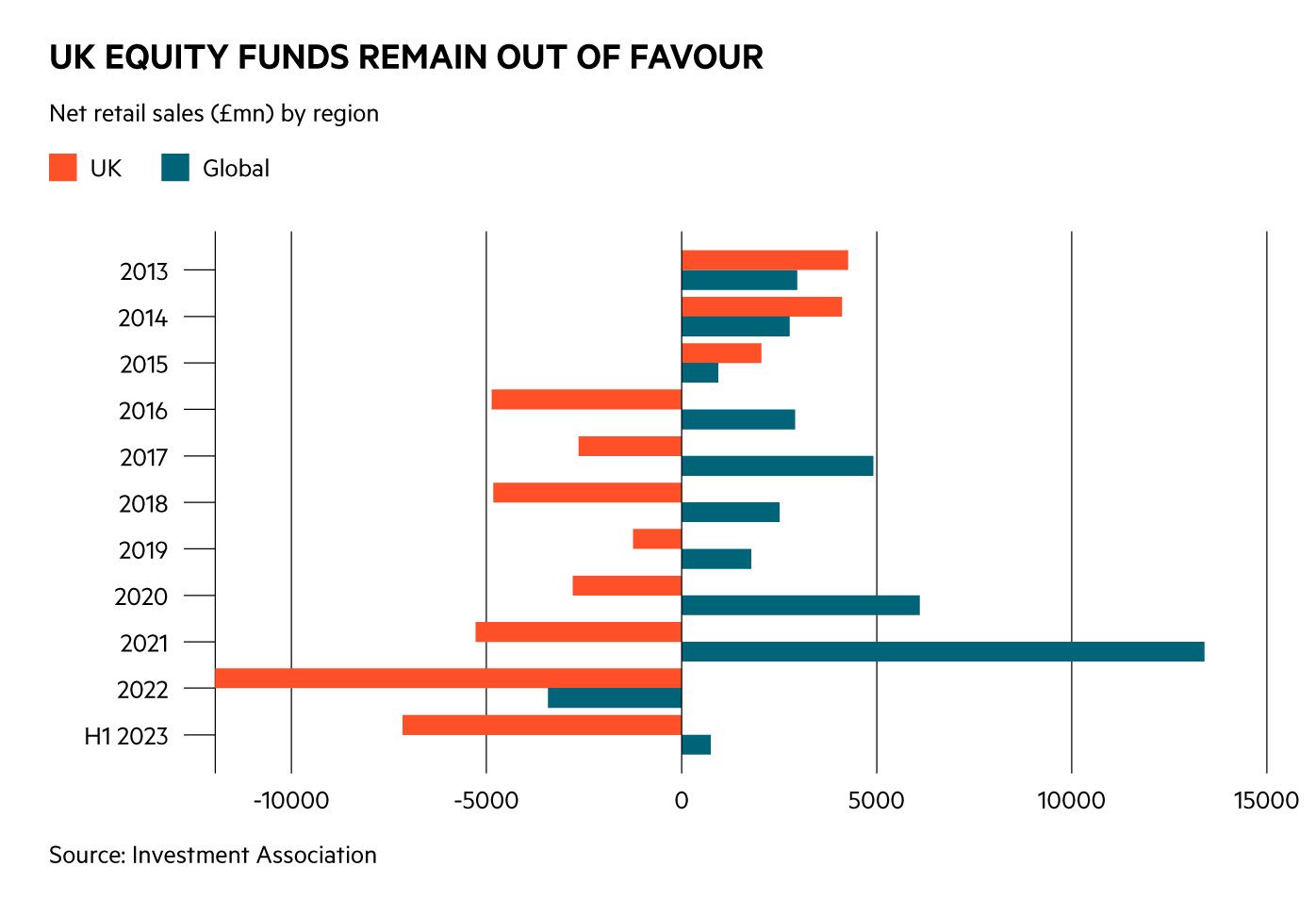

The UK stock market has found itself short of friends in recent years: investors have abandoned UK equity funds en masse since 2016, the FTSE All Share has struggled against other indices and companies listed here have even considered upping sticks. Prominent investors from hedge fund manager Paul Marshall to the UK equity aficionado Nick Train have even weighed in, criticising companies on the domestic market for a fixation with paying dividends, potentially at the expense of growth.

As such, UK equities have tended to look ‘cheap’ for many years, and those hoping prices might finally recover do have some reasons for optimism. Train has argued that US investors have grown more prominent on the boards of FTSE 100-listed companies, meaning such businesses may well start to prioritise internal investment and organic growth over dividend payouts. There’s also hope that broader reforms, including a shake-up of the individual savings account (Isa) regime, could help bolster the appeal of UK shares.

This of course could be wishful thinking, and panellists on the latest Investors’ Chronicle webinar, 'Maximising stock picks in an undervalued market: Finding opportunities in the UK stock market' were quick to manage any expectations of a quick turnaround. One key message of the session related to the fact that many of the big names on the UK market, including but not limited to the likes of the energy majors, focused on dividends in part because they would struggle to find easy sources of organic growth.

“It’s very difficult for a company, say a food retailer, to do something different,” noted Simon Gergel, portfolio manager on the Merchants Trust. Tineke Frikkee, head of UK equity research at Waverton Investment Management, added that a high dividend yield of around 8 per cent or so could point to the fact that a company probably lacked easy investment opportunities – while those with lower yields might have more promise here.

And yet this isn’t necessarily a bad thing, with many sectors commonly viewed as being ‘ex-growth’ continuing to generate strong total returns thanks to a good level of dividend payouts and, more recently, substantial share buybacks. Such stocks can continue to work well in income portfolios while the companies, in Gergel’s view, can sometimes do well to “stick to their knitting” rather than expanding too aggressively and running into trouble.

DIVIDEND PROSPECTS

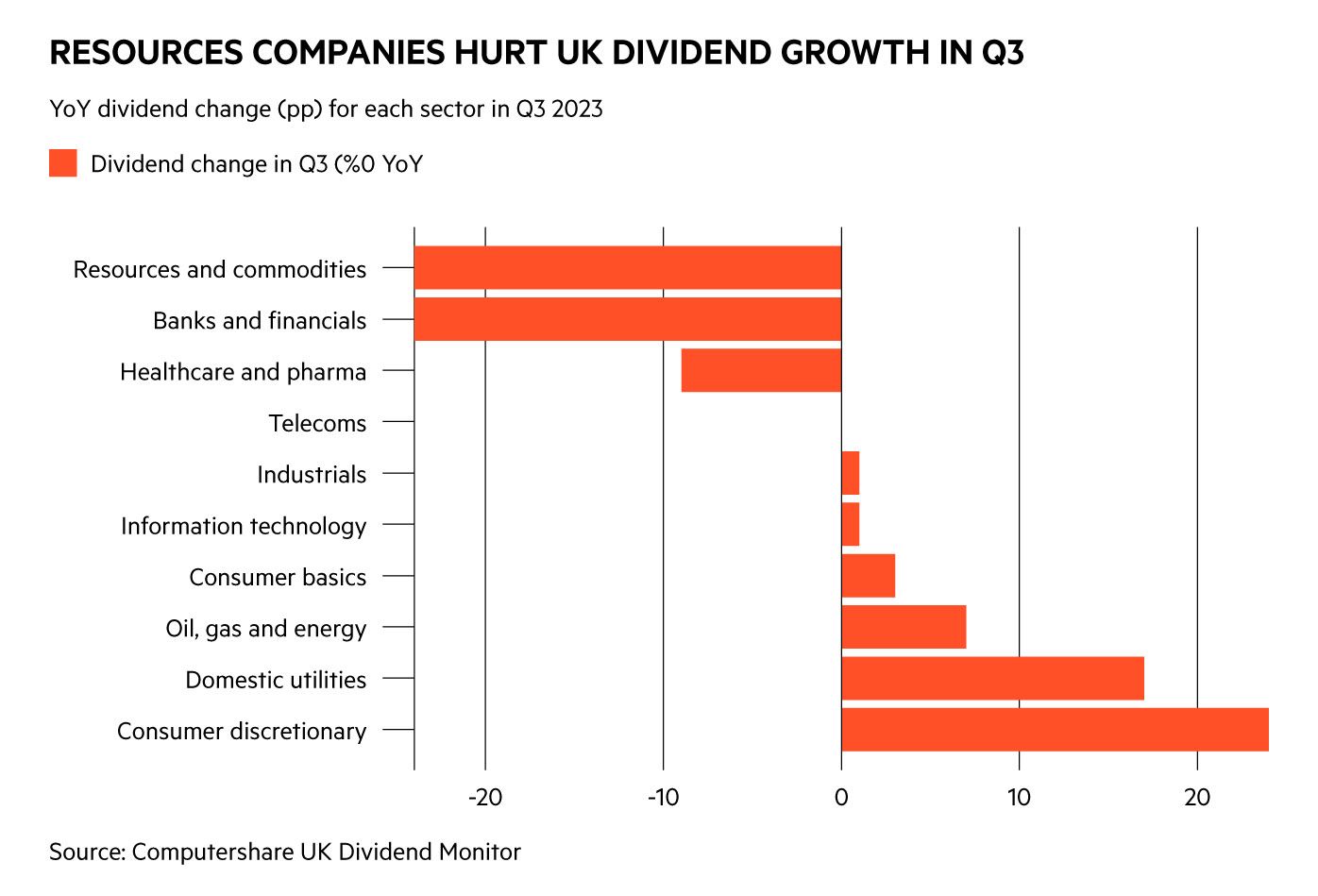

But what of UK shares as an income play? There’s currently plenty of competition for space in an income portfolio, with the ‘risk-free’ 10-year UK government bond still yielding more than 4 per cent. And while UK company dividends have recovered strongly from the cuts of 2020, there can still be bumps in the road: the Computershare UK Dividend Monitor notes, for example, that UK dividends fell by 8.3 per cent in the third quarter of this year thanks to a steep fall in the payouts from mining companies.

The latest report forecasts that the FTSE 100 will generate a yield of 4 per cent over the next year with the FTSE 250 managing 3.5 per cent – something that looks uncompetitive versus the interest currently available from both bonds and savings accounts.

A counter to this point is that companies can continue to grow their dividends over time, doing a much better job of supplying an income that keeps up with inflation than the likes of bonds or cash. And when it comes to dividend growth there’s one particular sector that stands out: banks.

Banks keep paying dividends but also, unlike other sectors, we expect dividend growth going forward

“Banks keep paying dividends but also, unlike other sectors, we expect dividend growth going forward,” said Elise Badoy, head of research, Emea, for Citibank. “There’s a high yield and dividend growth – we find that in very few other sectors.” Gergel also pointed to the sector’s strong free cash flow generation, and the fact that banks may benefit from their conservative lending practices even if an economic downturn rears its head.

Not all are so optimistic, with Frikkee arguing that banks “might just tread water due to the fact that homeowners have to refinance mortgages at higher interest rates, depressing demand in the sector. UK-listed banks with a focus on Asia have different factors to contend with, including the state of the Chinese real estate market.

If a central case for investing in banks in recent years has related to the strength of their balance sheets in the aftermath of the financial crash, the panel struck a sanguine view on the likes of energy companies, arguing that discipline on spending should help them avoid any major mishaps. Constraints on production should also mean that supply and demand for energy remains well balanced, freeing up money for companies in the sector to invest in the energy transition.

EXCITING TRENDS

Even if much of the UK market is viewed as more of an income play, there are ways to tap exciting trends. When one viewer asked if the market’s biotech offerings might be limited to rare IPOs such as that of Oxford Nanopore in 2021, Frikkee argued that such exposure could be taken on, albeit indirectly, via the UK-listed pharma majors.

And when the discussion almost inevitably turned to the subject of artificial intelligence, she pointed to the fact that companies with proprietary datasets could be big winners, eventually.

Katya Gorbatiouk, head of investment funds for the London Stock Exchange Group, added that venture capital trusts and more mainstream investment companies could offer exposure to growth themes via their holdings in private companies. “You get access to younger, higher-growth companies that may list eventually but may choose to stay private,” she said.

As such, the UK market can still offer some promise for both the income investor and those seeking capital growth. But if recent years are any guide this might require a good level of patience and a selective approach.

Supported by